capital gains tax news today

We offer insights from professionals across the accounting industry you can join us here. You may owe capital gains taxes if you sold stocks real estate or other investments.

Biden To Propose Nearly Doubling Capital Gains Tax For The Rich Tax News Al Jazeera

Capital Gains Tax 101.

. Major income tax changes in last 10 years and how they have impacted your investments. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Latest news on Capital Gains Tax in the United States where individuals and corporations pay US federal income tax on the net total of all their capital gains.

Record amount paid by investors which is likely to increase in the coming years. The estate tax exclusion will grow in 2023 to 1292 million from 1206 million in 2022. Capital gains tax take hits 10bn use these tricks to pay less.

Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one floated change to capital gainsBiden has called. Published 7 days ago. By Harry Brennan 5 Aug 2021.

The Department of Revenue DOR this week responded to the October 5 letter from the Citizen Action Defense Fund CADF asking the agency to cease and desist its capital. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 long. It has also suggested.

There are also intermediate brackets at 12 22 24 32 and 35 rates. That means that until your estate exceeds 1292 million you will not owe any tax. Monday October 10 2022.

By holding an investment for a year or more you will qualify for long-term capital gains tax rates. A capital gain is computed by subtracting the purchase price of an asset from the selling price. Long-Term Capital Gains Taxes.

The income tax brackets are graduated which means. Today the market value of the home is 300000. If your mom passes on the.

For 2021 tax rates on short-term capital gains range from 10 to 37. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. You might be thinking about selling some assets to realize those capital gains.

Capital Gains Tax News. It was announced that long-term capital gains beyond Rs 1 lakh from stocks equity funds. So if you bought a stock for 1000 and sold it for 2000 you would realize a capital gain of 1000.

News about Capital Gains Tax including commentary and archival articles published in The New York Times. Thats the good news. Today News Currently if a couple transfers assets between them any time after the tax year in which they separated there may be a tax to pay.

Capital Gain Selling Price Purchase. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Basic Rules Investors and Others Need to Know capital gains tax Learn the ins and outs of the capital gains tax which you may owe if you sell stocks your home.

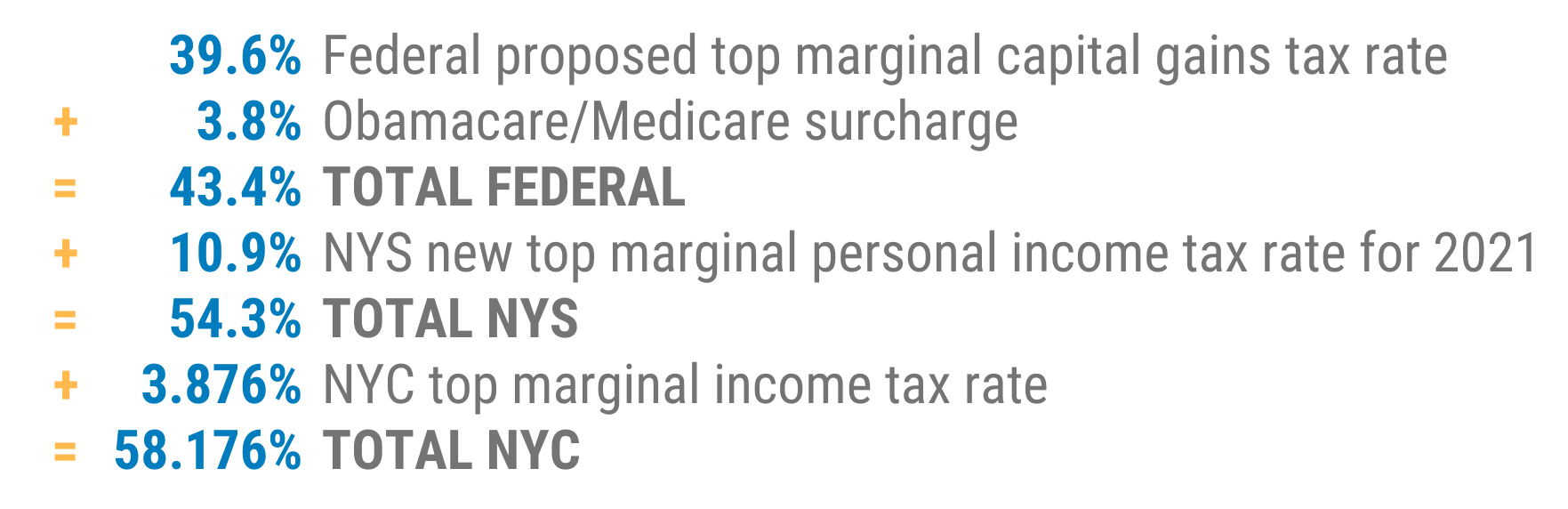

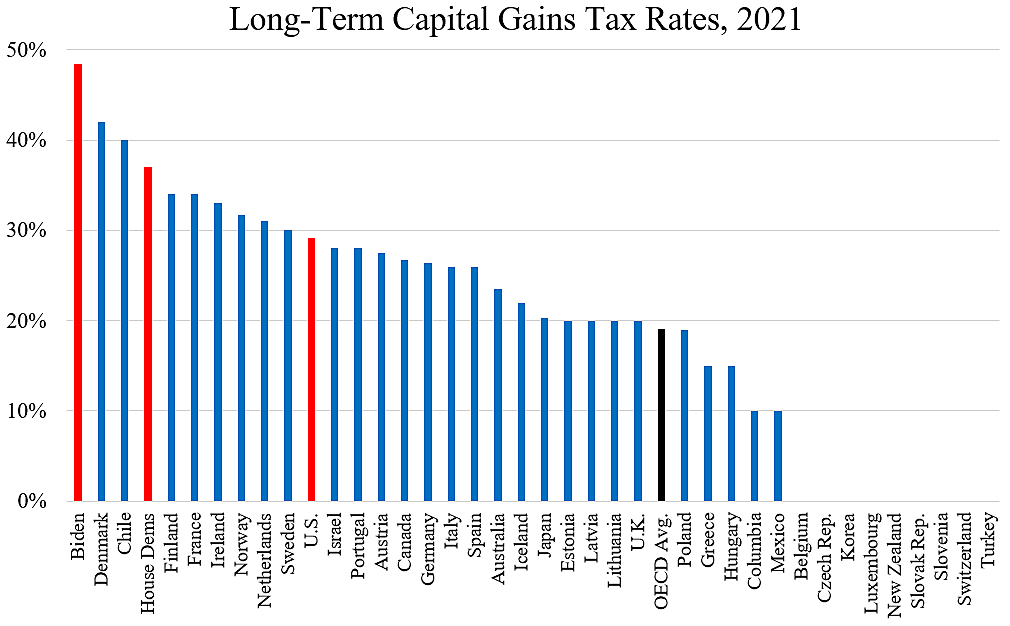

One of the changes announced was in April 2018. The administration has proposed nearly doubling the long-term capital gains tax rate to 396 for households with 1 million or more in annual earnings. For 2023 you may qualify for the 0 long-term capital gains rate with taxable income of 44625 or less for single filers and 89250 or less for married couples filing jointly.

Read Capital Gains Tax news on the Accountancy Today website. Use SmartAssets capital gains tax calculator to figure out what you owe. If you want to avoid that you should choose long-term investments instead.

You will owe tax on this 1000 capital gain during the tax year when you sold the asset.

Capital Gains Taxes And The Democrats Cato At Liberty Blog

2022 Income Tax Brackets And The New Ideal Income

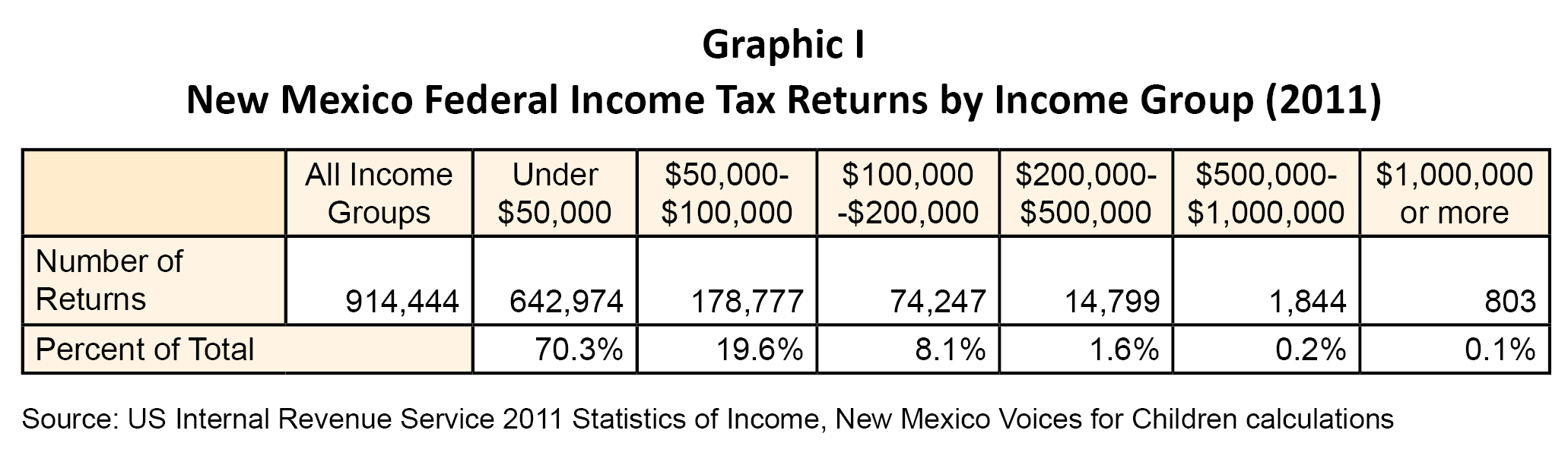

New Mexico S Capital Gains Deduction A Capital Loss For New Mexicans New Mexico Voices For Children

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Investors Doubt U S Capital Gains Tax Plan Alone Can Derail Market Rally Reuters

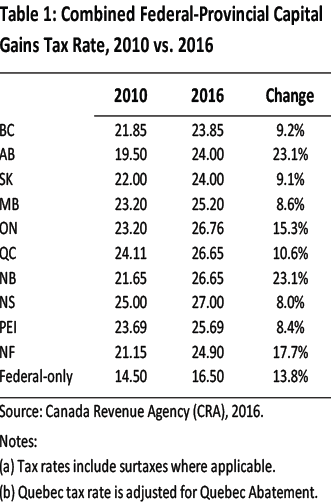

Personal Income Taxes And The Capital Gains Tax Fraser Institute

Crypto Capital Gains And Tax Rates 2022 Crypto News

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

New Recommendations For Capital Gains Tax Raid On Landlords

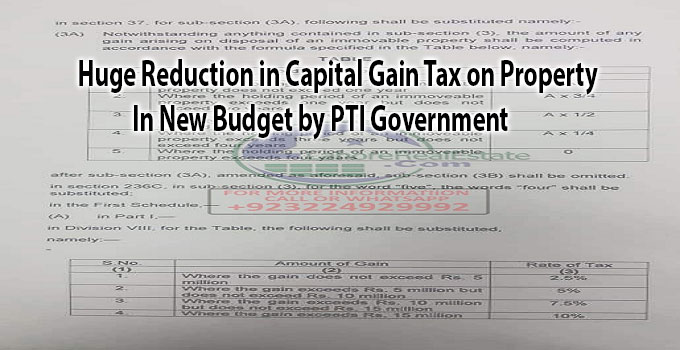

Huge Reduction On Capital Gain Tax On Property In New Budget By Pti Government Lahore Real Estate

Long Term Capital Gains Tax Latest Breaking News On Long Term Capital Gains Tax Photos Videos Breaking Stories And Articles On Long Term Capital Gains Tax

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Judge Overturns Washington State S New Capital Gains Tax Lynnwood Times

Govt Collects Capital Gains Tax Of Rs 11 03 Billion From Share Transactions As Of May End Myrepublica The New York Times Partner Latest News Of Nepal In English Latest News Articles

Capital Gains Tax Definition Taxedu Tax Foundation

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)